About DIPAM

Department of Investment and Public Asset Management (DIPAM) deals with all matters relating to management of Central Government investments in equity including disinvestment of equity in Central Public Sector Enterprises(CPSE's). The three major areas of its work relates to Strategic Disinvestment, Minority Stake Sales and Capital Restructuring. All matters relating to sale of Central Government equity through offer for sale or private placement or any other mode as well as strategic disinvestment of CPSE's is dealt with in DIPAM. DIPAM is a Department under the Ministry of Finance.

Mandate of DIPAM

MARKET & DISINVESTMENT UPDATES

Daily Update BSE

Interactive chart showing Daily BSE update. Use toolbar buttons to zoom or pan data.

Market Capital Value of GOI Equity in Listed CPSEs

| Company Details | |

|---|---|

| Name : | OIL AND NATURAL GAS CORPORATION LTD |

| Number of GOI Shares : | 7,408,867,093 |

| Closing Price : | 270.05 |

| Market Capitalization of GOI Shares ( In Crore) : | 200,076.46 |

| Total Market Capitalization : | 339,730.44 |

| Total % of GOI Shares : | 58.89% |

Market Capital Value of GOI Equity in Listed PFIs

| Company Details | |

|---|---|

| Name : | STATE BANK OF INDIA |

| Number of GOI Shares : | 5,079,775,288 |

| Closing Price : | 1,098.70 |

| Market Capitalization of GOI Shares ( In Crore) : | 558,114.91 |

| Total Market Capitalization : | 1,014,167.95 |

| Total % of GOI Shares : | 55.50% |

MEDIA INTERACTIONS

IN NEWS

EVENTS

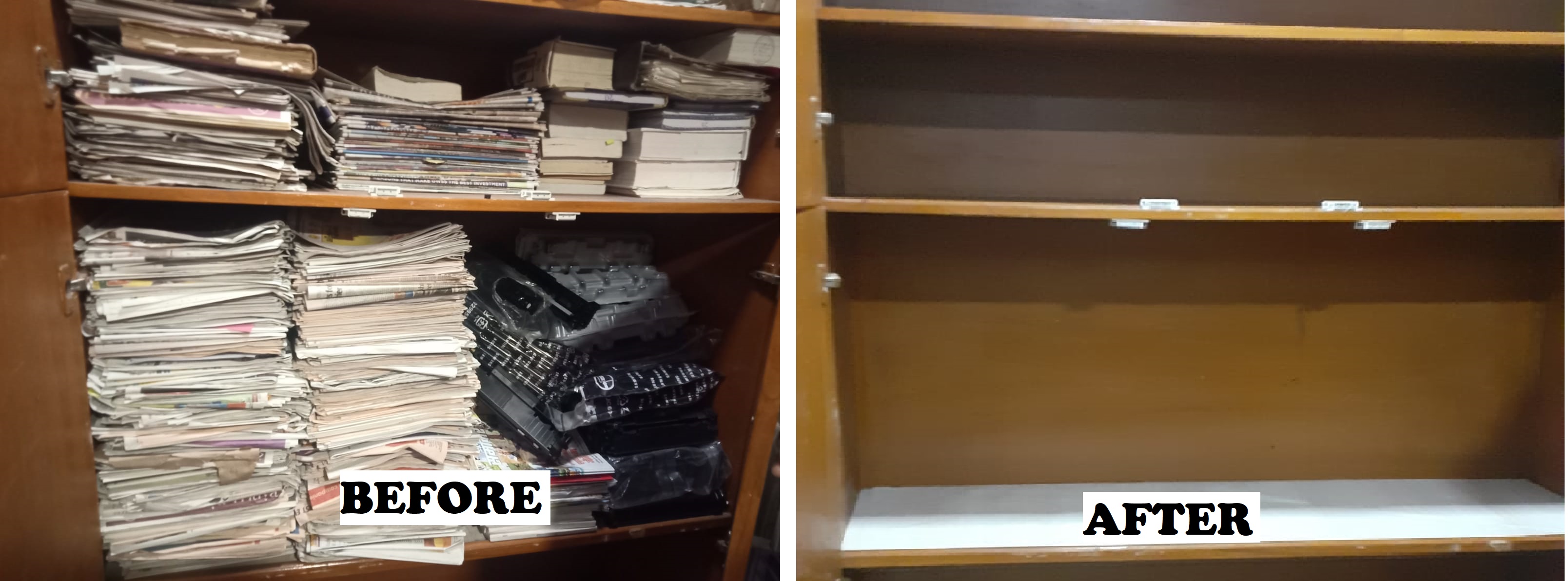

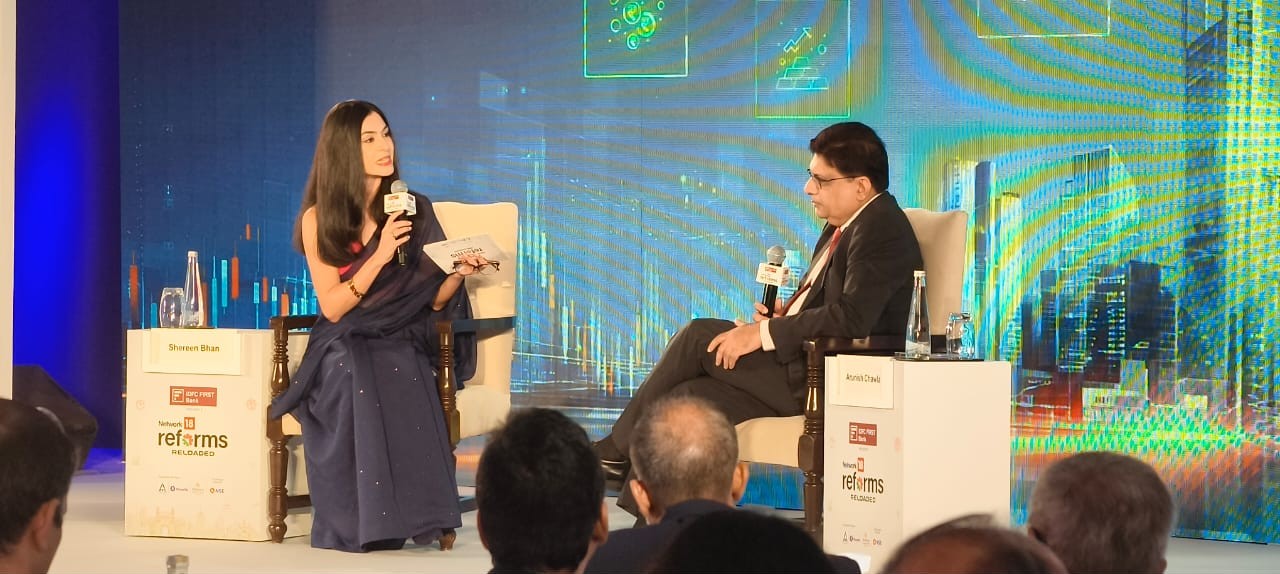

DIPAM Secretary Arunish Chawla On Disinvestment, GST 2.0 & Govt’s Push to Boost Economy | #ReformsReloaded | News18

Enlarged view of the selected image

DIPAM Secretary Arunish Chawla On Disinvestment, GST 2.0 & Govt’s Push to Boost Economy | #ReformsReloaded | News18

Enlarged view of the selected image

DIPAM Secretary Arunish Chawla On Disinvestment, GST 2.0 & Govt’s Push to Boost Economy | #ReformsReloaded | News18

Enlarged view of the selected image

DIPAM Secretary meeting with Mr. Ajay Banga,World Bank Group President

Enlarged view of the selected image

Listing of SCILAL - Shipping Corporation of India Land and Assets Limited

Enlarged view of the selected image

Listing of SCILAL- Shipping Corporation of India Land and Assets Limited

Enlarged view of the selected image

Listing of IREDA - Indian Renewable Energy Development Agency Limited

Enlarged view of the selected image